1 million could get mortgages reduced by average of $20,000;

750,000 could get $2,000 checks

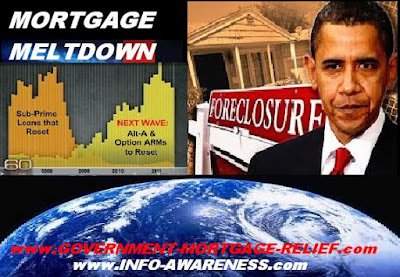

Feb-06-2012--WASHINGTON - California and New York were considering Monday whether to join most other states in backing a long-awaited settlement with banks over foreclosure abuses. The deal would require the five largest mortgage lenders to reduce loans for about 1 million households. The reduced loans would benefit homeowners who are behind on their payments and owe more than their homes are worth. The lenders would also send checks for about $2,000 to hundreds of thousands of people who lost homes to foreclosure.

The money available to homeowners could run as high as $25 billion if all states approve the deal.

The five lenders — Bank of America, JPMorgan Chase, Wells Fargo, Citigroup and Ally Financial — have already agreed to the settlement. In settling the charges, the states would agree not to pursue further investigations against the banks in civil court. The deal would not protect the banks from criminal investigations.

The few states that have resisted the deal have expressed concern that it would limit their ability to take action against the banks for any past wrongdoing that turns up later. California’s backing is particularly crucial. It was among the states hardest hit by the foreclosure crisis. And it has the most residents “underwater”: They owe more on their loan than their home is worth. Without California’s participation, the money available to homeowners nationally would be about $19 billion rather than $25 billion.

The settlement would apply only to privately held mortgages issued from 2008 through 2011. Banks own about half of all U.S. mortgages — roughly 31 million loans. The settlement would end a painful chapter that emerged from the 2008 financial crisis, when home values sank and millions edged toward foreclosure. Many companies that process foreclosures failed to verify documents. Some employees signed papers they hadn’t read or used fake signatures to speed foreclosures — an action known as robo-signing.

INFO-AWARENESS - VIKEN Z KOKOZIAN - 88888FORCEINFO-AWARENESS

http://government-mortgage-relief.com

http://www.youtube.com/88888force

http://www.nationalshortsalebrokers.com

http://government-mortgage-relief.blogspot.com

http://info-awareness.blogspot.com

http://vikenzkokozian.blogspot.com/

http://88888force.blogspot.com/

http://fightthebank.blogspot.com/

http://fight-the-bank.blogspot.com/

http://truth-perception.blogspot.com/

http://twitter.com/INFOAWARENESS

1-858-366-4777 Skype

1-800-270-2928